Building Your Wealth From Nothing: Starting From $0

This post may contain affiliate links. For more info read my disclosure.

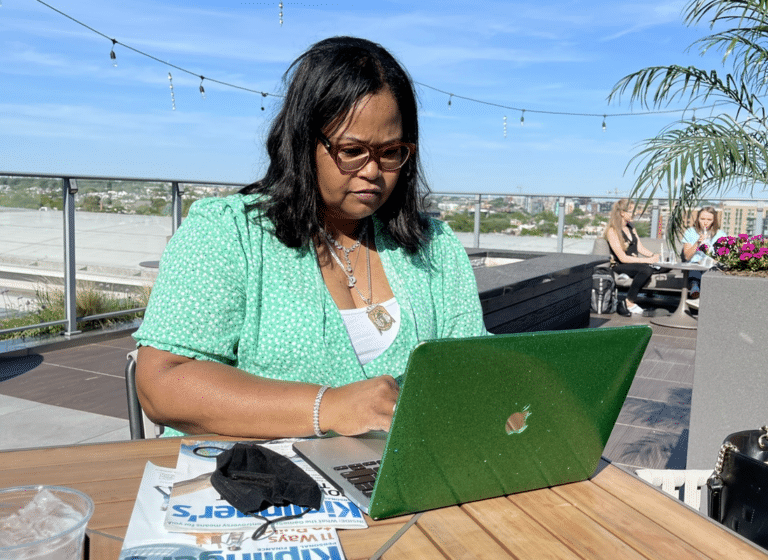

A question that It’$ My Money receives often when working with adults and youth is where do you even begin in building wealth? How can one invest and buy into certain things when they don’t have any money? It’s a realistic and great question to ask because unfortunately there is no tree down the road to go pick money off of, and sometimes the idea of job management, money management, AND life management is a lot. This week we are covering the fundamentals- something the It’$ My Money team is passionate about. Always remember small steps, whether you are starting for the first time OR you are trying to get yourself back up.

Mindset over Everything: Wealthy Thoughts

Many of us hear the daunting words of “mental health” and just change “your outlook”. It’s hard, there is no doubting that. But the worst event, happening, or thing in your life has happened, you have lived and now it’s time to grind. Find yourself changing your mindset from I don’t have _ to I have _. Imagine your goals as tangible items, and imagine how it feels to have them.

For example, let’s say you want to save 70k in your bank account in 5 years. Now imagine that. Imagine the feeling of opening your phone, looking at your screen, and seeing that balance. Imagine the feeling of paying your bills and still having extra money to put aside for another fund. Imagine the relief, the relaxation- and use that to fuel your physical actions.

If you subconsciously doubt yourself or are stressed, it will be harder to overcome those barriers. Mental Health = Mental Wealth!

Employment: Finding a job or making your own

Whether you are freshly 16 or 61, all of us are chasing something we love to do. Have that in mind when finding employment, but also see employment as a stepping stone to your financial journey. Your first job might not be your end at all however it’s important that you begin collecting your paycheck to start to jumpstart your wealth. Find employment through places like Indeed, LinkedIn, and in-person. And always keep your wealth mindset at the front of every action- even if the job is minimum wage, you are STILL making money. It’s the decisions about what you do with the money that really matters.

When you begin employment it’s vital that you opt in to direct deposit to really optimize your savings. If you don’t know how to set that up, let’s talk about what you will need:

- Saving and Checking Account

- Routing Number

- Account Number

What does this mean exactly? When you open a savings and checking account, you will be given an attached routing number and account number. This information can be provided to your employer for direct deposit. Meaning, that when payday comes around your money will go directly into your account.

We often discuss side hustles with our audiences, as a way to make extra money. For many of you, you might not know what to do or you might feel some doubt in how to begin.

Side Hustles: The Extra Cash Flows

Once you have a few hundred dollars (as a base to begin) you really can begin a side hustle. Think about what you are good at, or something you are passionate about. How can you monetize this? Here are a few examples of passions turned into cash:

A love for fashion, beauty, and brands turned to Online Influencer

Making content is free, and the power of social media is so strong that brands have ambassador programs. Create a free social media account, start snapping photos of your products, share your opinions, tag the brand, and engage often with others in the community. Storefronts like Amazon are a great way to make that extra cash.

A love for dogs turned to Dog Watcher/Walker

Do you have animals of your own? Do you really enjoy animals but can’t currently afford one yourself? Becoming a dog walker or watcher for people and families that are busy is a great way to make money while doing something fun (as long as you get well-behaved dogs 😉)

A love for art turned to Graphic Designer for Small Business

If you find yourself loving online artwork, animation, editing, and anything physically creative, many small businesses online are looking for graphic designers or marketing associates to help them launch their businesses. These may be internships or jobs but regardless, if you pull together your work into a portfolio, you have a world of opportunity. Use free platforms like Canva to create your portfolio.

A love for talking turned to Podcast Host

It sounds silly but do you ever just have so much to talk about? Maybe it’s you or you and your friends, but why not monetize that? Starting a podcast is a great way to let out some laughter, share some advice, or just have an outlet to talk. Click here to learn how to start your own podcast!

Organization: The Key to Success

Whether you have one job or four, it’s vital to keep organized and to make sure you are tracking your spending, incoming money, and any other wealth information. Let’s talk about it:

Create a Budget

Track your income, and outline your monthly expenses. These expenses can include monthly rent, car payments, and more. An easy way to start this is by utilizing budget envelopes.

Set Financial Goals

A part of organization is also being clear in your own goals. Know what you want, and continue to track it.

Starting from nothing is possible, as scary as it may sound. With a mindset shift, the start of a job, and the passion to start a side hustle- you can begin. Always remember that wealthy isn’t the amount of money you have, it’s the mindset and desire to push for more. If you’re looking for more resources, check out my podcast, The Money Exchange.